The crypto rate tax returns for New Zealand businesses are filed on or before the first year of your operations. Contact us to ensure you are prepared for tax and have the right strategy in place.

Cryptocurrency Tax Nz - If you're looking for video and picture information linked to the keyword you have come to visit the right blog. Our site provides you with hints for seeing the maximum quality video and picture content, search and find more informative video articles and graphics that fit your interests. includes one of thousands of video collections from various sources, especially Youtube, so we recommend this video that you view. This site is for them to stop by this site.

2019 Paying New Zealand Crypto Tax By Tom B Medium

Work out your cryptoasset income and expenses.

Cryptocurrency tax nz. This is due to their promising future limited supply and ability to be safely be stored long term. Cryptocurrency is taxed under s CB4 of the Income Tax Act which makes the distinction between capital and revenue irrelevant. Receiving a payment in cryptoassets.

In Cryptocurrency Tax Entity Structure 1 Comment The Labour Party has announced that if re-elected they would introduce a new marginal tax rate of 39 for an individuals income over 180000. You will need to work out what the NZD value of the BTC was when you bought it and then work out what the NZD value of the ETH was when you made the trade. People can buy sell and exchange cryptoassets.

Self-employed Kiwis are considered and taxed as individuals. Exchanging your cryptoassets for different cryptoassets. Some cryptoasset transactions may not have an NZD value such as.

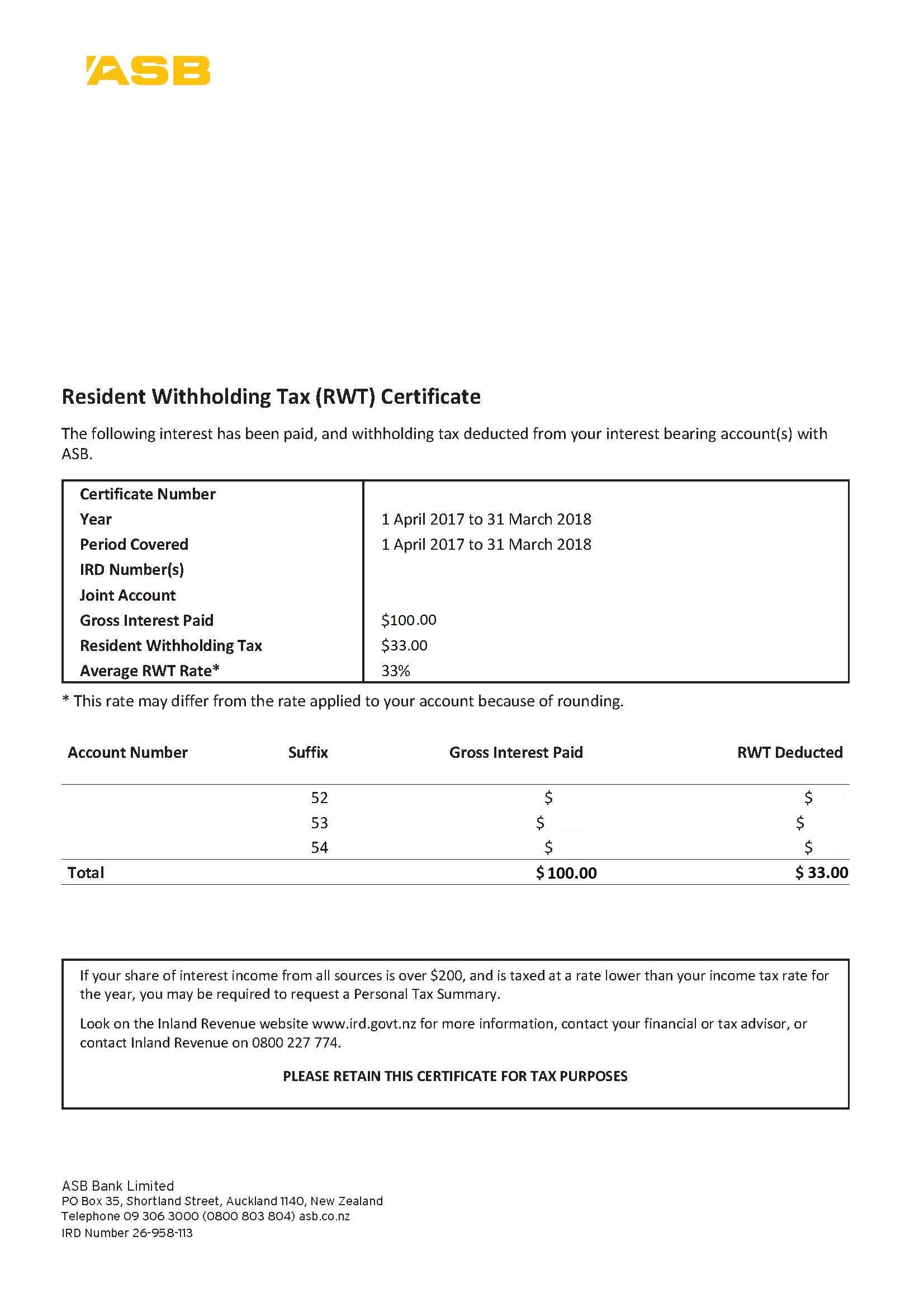

Up next in 8. You need to use amounts in New Zealand dollars NZD when filing your income tax return. If playback doesnt begin shortly try restarting your device.

We provide tailored and proactive cryptocurrency tax advice to all clients anywhere throughout New Zealand. Receiving mining or staking rewards. Before you can put your cryptoasset net income or loss in your tax return you need to.

These vary depending on the type of activity and your situation. Wednesday September 9th 2020 600AM. Cryptocurrencies like Bitcoin are becoming an increasingly popular long term investment asset for Kiwis.

Find out what you need to know about cryptoassets and your tax. The net profit is taxable at your marginal tax rate ie. Cryptoassets are treated as a form of property for tax purposes.

Income from cryptoassets is subject to New Zealand tax only if the income has a source in New Zealand. Provide goods or services in exchange for them. There are two types of tax that can apply to crypto assets.

Calculate the New Zealand dollar value of your cryptoasset transactions. In summary although in both examples 3 and 4 Alice earns 100000 of cryptocurrency income she pays more tax at higher rate in example 4 354 compared to 239 in example 3 because of the NZ marginal tax rate system. The second and third situation raises a key question of what is the source of income from cryptoassets which is not an easy question when the transactions take place on a distributed ledger.

The taxation of trade income is well documented in basic New Zealand income tax legislation both in the form of ordinary cash based payments and in the sense of barter arrangements. However if youve moved your cryptocurrency from one coin to another eg BTC to ETH then that move is taxable. Tax on Cryptocurrency.

It does not depend on what they are called. Income tax and goods and services tax GST. Provisional tax combined with GST payments is paid in instalments after the first year.

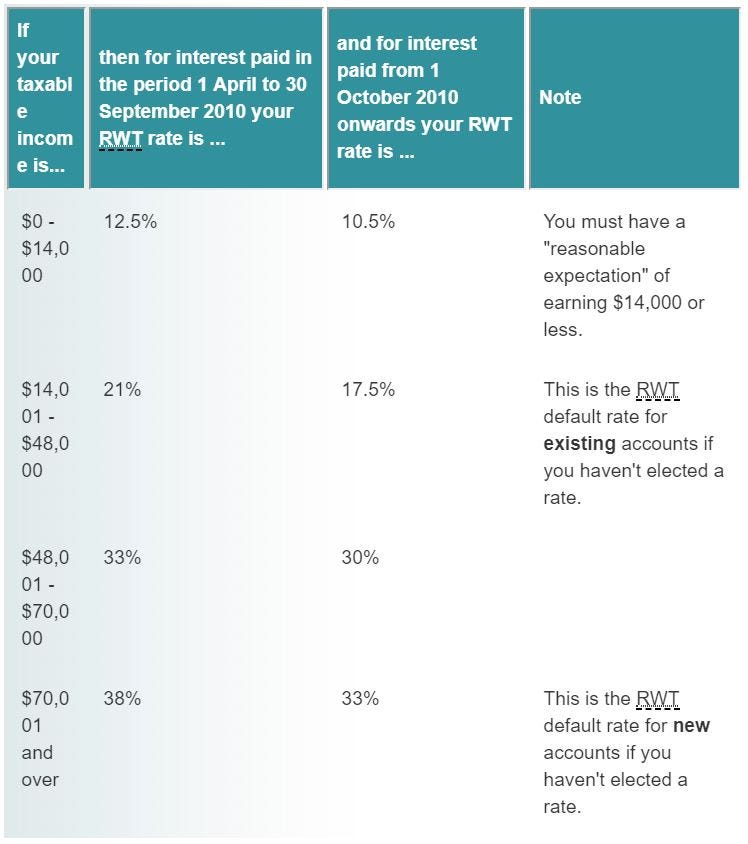

Inland Revenue is providing tax guidance for investors who earn money from cryptoassets. Given that New Zealand does not have a broad capital gains regime this means that generally cryptoassets will be taxable only when the taxpayer. Work out if you need to pay tax on amounts you get when you sell trade exchange or lend your cryptoassets.

While there are different types of cryptoassets the tax treatment depends on the characteristics and use of the cryptoassets. The more total income the more tax is paid as a percentage of overall income. Whilst unrealised cryptocurrency gains or losses are not recognised from the mere ownership of cryptocurrency if the cryptocurrency is received as a payment of.

The 39 tax rate would only apply to income over 180000 and the remainder of an. Opening stock value of cryptoassets assuming you are actively trading them These amounts also need to be converted into NZ dollars as at the time of the transactions. Crypto Tax NZ - Interview with Easy Crypto.

Bitcoin alone increased 212 over 2020 achieving the title as the best performing investment asset of the 2010s. Spokesman Tony Morris said it was designed to provide certainty for taxpayers with cryptoassets. GST In New Zealand any goods and services traded local or imported incur 15 GST.

If you havent sold your cryptocurrency then no tax applies. You need to be aware of your tax obligations if youre involved in acquiring or disposing of cryptoassets. Weve outlined further information about this on our latest article.

Income tax Currently all New Zealanders must pay income tax on their cryptocurrency proceeds from taxable events explained below. Following the trend seen in earlier rulings 3 on cryptoassets Inland Revenue has confirmed that digital assets should be treated as a form of property for tax purposes as opposed to currency. You need to file a tax return when you have taxable income from your cryptoasset activity.

Cryptocurrency Tax in New Zealand. There is no special tax rate for cryptoasset income. In New Zealand just like any other activity that you do to make a profit such as running a business trading stocks or setting up a lemonade stand you need to pay income tax on the profits you make including the gains on your cryptocurrency assets.

Evans Doyle 2 Kirkwood Street Cambridge 3450 020 4122 4440 timevansdoyleconz.

New Zealand Says No Special Tax Rules For Cryptocurrency

Tim Doyle Cryptocurrency Tax Nz

2019 Paying New Zealand Crypto Tax By Tom B Medium

Guide To Cryptocurrency Taxes In Nz Glimp

Taxoshi New Zealand S Tax Calculator Easy Crypto

Cryptocurrency Tax Nz Chartered Accountants And Cryptocurrency Specalists

New Zealand Calculate And File Bitcoin Crypto Taxes Coinpanda

Declaring Crypto Taxes In New Zealand Inland Revenue Koinly

2019 Paying New Zealand Crypto Tax By Tom B Medium